TORONTO, ON – April 28, 2021 – Pasinex Resources Limited (CSE: PSE) (FSE: PNX) (The “Company” or “Pasinex”) today reports the Company’s financial and operating results for the year ended December 31, 2020.

Andrew Gottwald, Chief Financial Officer of Pasinex, commented, “2020 will largely be seen as a year of preparation for Pasinex, with 2021 expected to be a transitional one due to the groundwork completed in 2020. Positive developments in 2020 included management changes and tax debt restructuring at the Company’s joint venture, the beginning of the development of a fourth adit and the addition of the Mahyalar claim. The positive developments along with the extension of the Gunman Project agreement will enable the Company to move its interests forward in the coming year.”

Highlights – 2020 Year End

Financial and Operational

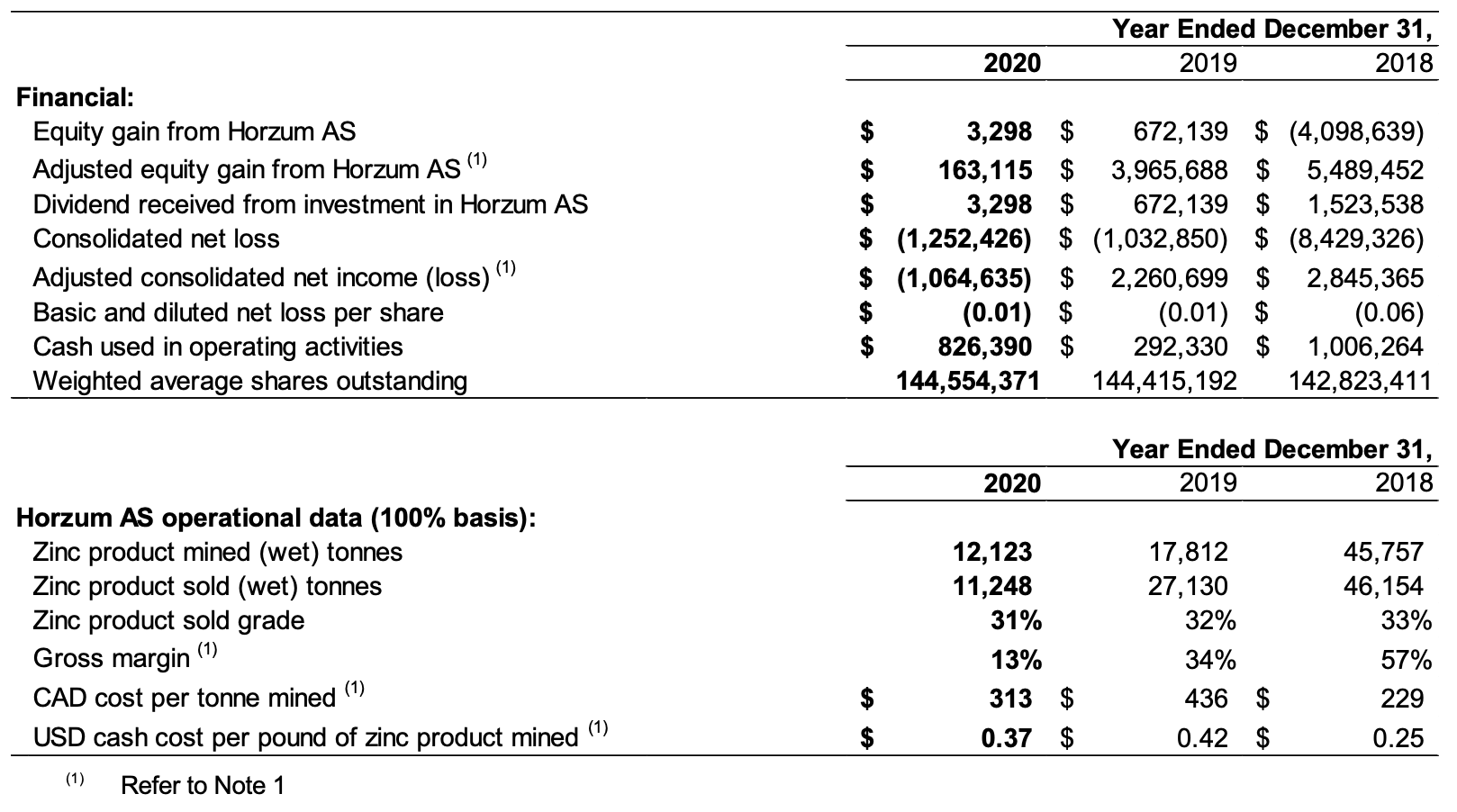

- For the year ended December 31, 2020, Pasinex incurred a net loss of approximately $1.25 million, compared with a net loss of approximately $1.03 million for 2019. The primary reason for the small increase in the net loss was the decrease of $0.669 million in the equity gain in 2020 when compared with 2019. The equity gain is equal to the total of the cash dividends paid in by Horzum AS to Pasinex Arama. The reduction of the dividend received was offset by lower costs incurred in almost every category of expense.

- The adjusted consolidated net loss (see Note 1) was $1.07 million for 2020 compared with an adjusted consolidated net gain of $2.3 million in 2019. The adjusted equity gain (see Note 1) was $0.16 million in 2020 compared with $4.0 million in 2019. These non-GAAP measures reflect what the results of the Company would be without the recording of the impairment charges in 2020 and 2019.

- The operating income in Horzum AS decreased from $4.6 million in 2019 to $0.6 million in 2020. This decrease was due to lower sales in 2020 as a result of fewer tonnes having been sold and lower zinc product prices having been realized on sales. These factors also resulted in the gross margin (see Note 1) for the year ended December 31, 2020, decreasing to 13% from 34% in 2019. In addition, costs to develop the fourth adit were included in cost of goods sold although they did not provide access to any zinc product in 2020.

- During the third quarter of 2020, Horzum AS began developing a new fourth adit at the 541-metre level, approximately 84 metres below the water table level, which occurs at the 625-metre level. By the end of 2020, approximately 310 metres of the fourth adit had been completed. In March of 2021 after reaching approximately 370 metres the development of the fourth adit had to be stopped due to safety concerns after encountering large volumes of groundwater. This was expected and Horzum AS has started to dewater the area in order to be able to continue the adit development. The dewatering process has been slowed with spring rains having increased the volume of groundwater. The Company now expects this to be completed by the end of May 2021. Thereafter, it is expected, that an additional two months of development will be needed to reach the targeted zinc sulphide.

- Starting the de-watering process has enabled Horzum AS to conduct further exploratory drilling at the 625-meter level. Subsequent to the year end, zinc sulphide was encountered and Horzum AS has started to successfully mine zinc sulphide product in that area. The deep zinc sulphide product is expected to contain a grade of between 40% to 60% zinc. The ground between the 625-metre level and the 541-metre level has had little exploration to date with the potential below the 541-metre level completely unknown. The fourth adit will allow this area to be drilled from underground and will enable the depth potential to be better delineated.

- Horzum AS completed a total of 6,421 metres, in 61 drill holes of underground and surface diamond core drilling during 2020. Of the holes drilled, 57 drill holes were underground totalling 5,395 metres and 4 surface drill holes totalling 1,026 metres. Horzum AS also completed a total of 1,373 metres of exploration and development adits during 2020.

- In the third quarter of 2020, Horzum AS received an exploration license for the Mahyalar claim, an area located to the east of the Pinargozu mine in the Mahyalar district of Kozan. The claim area is approximately 18 km2 in size and is located in the Pasali Fault zone. The exploration license is valid for seven years. Fieldwork conducted to date has shown elevated zinc levels from rock and soil samples. Exploration including the collection of further rock and soil samples, along with geological mapping, will be conducted over the next year.

- In the fourth quarter of 2020, the Company successfully entered into an amending agreement with Cypress and Caliber to extend the deadline for completing the minimum exploration expenditures to December 31, 2022. In addition, the deadline to acquire the additional 29% interest has been extended to December 31, 2024.

- Personnel changes during the year included the resignation of the Chief Executive Officer.

- During 2020, the Company received $905,500 from shareholders of the Company. Subsequent to the end of the year the Company received an additional $240,000 from those related parties.

Summary of Pasinex Situation in Turkey

- The value of the loan receivable from Akmetal and one of its subsidiaries, to Horzum AS as at December 31, 2020, is approximately $34 million compared with approximately $35 million as at December 31, 2019. Also, as at December 31, 2020, Horzum AS owes Pasinex Arama approximately $2 million that arose upon the declaration of a dividend in 2018 and invoices for management fees issued by Pasinex Arama to Horzum AS.

- Management has continued its contact with senior executives of the Kurmel Group during and subsequent to 2020, while the Kurmel Group has been working on strengthening its financial condition. Unfortunately, the Covid-19 pandemic brought to a halt the Kurmel Group’s ability to sell certain of its assets in the middle of 2020. Although the Kurmel Group was able to resume this process later in 2020, it was slowed by the continuing pandemic. Pasinex continues to work toward resolving the financial issues and debts owed by Horzum AS.

- In the third quarter of 2020, the joint venture underwent certain management changes resulting from these continued discussions. Those management changes include the appointment of Pasinex AS employees in the roles of acting Managing Director of Horzum AS and acting Exploration Manager of Horzum AS.

- Horzum AS restructured its tax liabilities in December 2020 as allowed by the Turkish taxation department. Horzum AS is scheduled to make instalments of its various tax debts, with each tax debt under its own schedule of 18 equal instalments. Akmetal has paid on behalf of Horzum AS two sets of instalments during the first quarter of 2021. The first set of payments was made on March 1, 2021, with the second set on March 31, 2021. The total amount paid was approximately $720,000 (TRY 4.44 million).

Note 1

Please note that all dollar amounts in this news release are expressed in Canadian dollars unless otherwise indicated. Refer also to the first quarter 2020 Management’s Discussion and Analysis (MD&A) and Audited Financial Statements found on SEDAR.com for more information. This news release includes non-GAAP measures, including adjusted equity gain from Horzum AS, adjusted consolidated net income, gross margin, cost per tonne mined and US$ cash cost per pound of zinc mined. A reconciliation of these non-GAAP measures to the GAAP financial statements is included in the MD&A.

About Pasinex

Pasinex Resources Limited is a Toronto-based mining company that owns 50% of the producing Pinargozu high-grade zinc mine and, under a Direct Shipping Program, sells to zinc smelters/refiners from its mine site in Turkey. The Company also holds an option to acquire 80% of the Spur high-grade zinc exploration project in Nevada. Pasinex has a strong technical management team with many years of mineral exploration and mining project development experience. The mission of Pasinex is to build a mid-tier zinc company based on its mining and exploration projects in Turkey and Nevada.

Visit our website at www.pasinex.com.

On Behalf of the Board of Directors

PASINEX RESOURCES LIMITED

“Andrew Gottwald”

Andrew Gottwald

Chief Financial Officer

Phone: +1 416.861.9659

Email: [email protected]

Evan White

Manager of Corporate Communications

Phone: +1 416.906.3498

Email: [email protected]

The CSE does not accept responsibility for the adequacy or accuracy of this news release.

This news release includes forward-looking statements that are subject to risks and uncertainties. Forward-looking statements involve known and unknown risks, uncertainties, and other factors that could cause the actual results of the Company to be materially different from the historical results or any future results expressed or implied by such forward-looking statements.

All statements within, other than statements of historical fact, are to be considered forward-looking. Although Pasinex believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not a guarantee of future performance, and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, continued availability of capital and financing, exploration results, and general economic, market or business conditions. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. We do not assume any obligation to update any forward-looking statements.