TORONTO, ON – May 24, 2022 – Pasinex Resources Limited (CSE: PSE) (FSE: PNX) (The “Company” or “Pasinex”)today reports the Company’s financial and operating results for the three months ended March 31, 2022.

Andrew Gottwald, Chief Financial Officer of Pasinex, commented, “This was an exceptional quarter for the Company, with the Joint Venture posting superb operating results both in sales and production, cash flowing from Horzum AS to Pasinex Arama and Pasinex Canada and the start of an exploration program on the Company’s Gunman Project in Nevada. The improvement in the Company’s balance sheet has been substantial and we are pleased to report we have sufficient cash on hand to fund our activities for the next year and beyond. A statement we haven’t been able to make in years. This has been a great start to what could become our best year yet.”

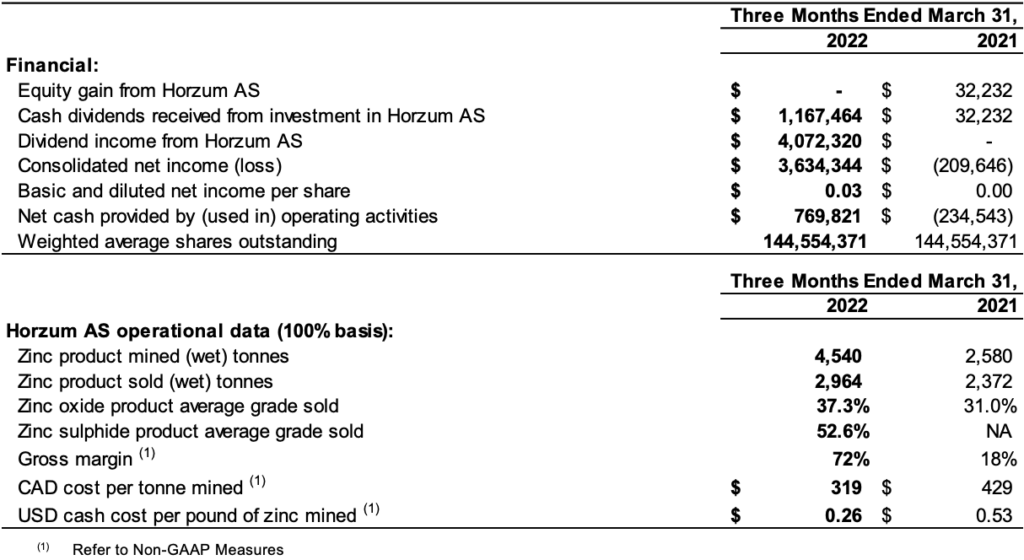

Selected Quarterly Information

Highlights

- Pasinex recorded a net income of approximately $3.63 million in the three months ended March 31, 2022, compared with a net loss of approximately $0.21 million for the same period in 2021. Pasinex Arama recorded dividend income of approximately $4.1 million in the first quarter of 2022. There was no similar amount in 2021.

- The operating income in Horzum AS increased to $3.3 million for the first quarter of 2022 versus operating income of $0.2 million in 2021. This increase was due to higher revenue generated from higher sales prices. The increased sales prices were the result of higher worldwide zinc prices in the first quarter of 2022 along with selling a greater proportion of high-grade zinc sulphide product in 2022 compared with 2021. The higher sales prices also resulted in the gross margin (see non-GAAP measures) for the three months ended March 31, 2022, increasing to 72% from 18% in the same period in 2021.

- Horzum AS declared a dividend to be paid to its shareholders of which Pasinex Arama was entitled to TRY 44.8 million. Pasinex Arama has received TRY 21 million of this amount as of the date of this Interim MD&A, bringing the total amount received by Pasinex Arama from Horzum AS in 2022 to TRY 30.7 million.

- Horzum AS sold approximately 2,500 tonnes of zinc sulphide product in the first quarter of 2022 at an average grade of 53% zinc and an average sale price of approximately US$1,318 per tonne.

- Horzum AS mined 4,540 tonnes of zinc product in the first three months of 2022, at the Pinargozu mine, including 3,842 tonnes of high-grade zinc sulphide product.

- The CAD cost per tonne mined (see non-GAAP measures) was $319 and the USD cash cost per pound of zinc product mined (see non-GAAP measures) was US$0.26 for the three months ended March 31, 2022.

- During the first quarter of 2022, Horzum AS completed a total of 2,494 metres of underground and surface diamond core drilling, in 22 holes, in the Fourth Adit and at the 616-metre level. It also completed 404 metres of exploration and development adit development.

- Horzum AS had another zero-fatality quarter at the Pinargozu Mine. There were 49,048 fatality free hours worked and no serious injuries were reported.

- The Company reached its US$200,000 of qualified exploration expenditures spending requirement at the Gunman Project during the quarter.

- The Company completed a review of its exploration data on its Gunman Project during the first quarter. Subsequent to the quarter end, the Company completed a helicopter magnetics survey and a soil sampling program and is now awaiting results from these programs. The Company is also in the process of completing a ground gravity program.

- The Company issued 1,500,000 stock options during the first quarter of 2022.

Non-GAAP Measures

Please note that all dollar amounts in this news release are expressed in Canadian dollars unless otherwise indicated. Refer also to the 2021 Management’s Discussion and Analysis (MD&A) and Audited Financial Statements found on SEDAR.com for more information. This news release includes non-GAAP measures, including gross margin, cost per tonne mined and US$ cash cost per pound of zinc mined. A reconciliation of these non-GAAP measures to the GAAP financial statements is included in the MD&A.

Qualified Person

Jonathan Challis, a fellow of the Institute of Materials, Minerals and Mining and a Chartered Engineer, is the qualified person (“QP”) as defined by NI 43-101 and has approved the scientific and technical disclosure herein. Mr. Challis is a director of the Company and Chair of Horzum AS.

About Pasinex

Pasinex Resources Limited is a Toronto-based mining company that owns 50% of Horzum Maden Arama ve Isletme Anonim Sirketi (“Horzum AS” or “Joint Venture”), through its 100% owned subsidiary Pasinex Arama ve Madencilik Anonim Sirketi (“Pasinex Arama”). Horzum AS holds 100% of the producing Pinargozu high-grade zinc mine. Horzum AS sells directly to zinc smelters and or refiners through commodity brokers from its mine site in Turkey. The Company also holds an option to acquire 80% of the Gunman high-grade zinc exploration project in Nevada. Pasinex has a strong technical management team with many years of mineral exploration and mining project development experience. The mission of Pasinex is to build a mid-tier zinc company based on its mining and exploration projects in Turkey and Nevada. Visit our website at www.pasinex.com.

On Behalf of the Board of Directors

PASINEX RESOURCES LIMITED

“Andrew Gottwald”

Andrew Gottwald

Chief Financial Officer

Phone: +1 416.861.9659

Email: [email protected]

Evan White

Manager of Corporate Communications

Phone: +1 416.906.3498

Email: [email protected]

The CSE does not accept responsibility for the adequacy or accuracy of this news release.

This news release includes forward-looking statements that are subject to risks and uncertainties. Forward-looking statements involve known and unknown risks, uncertainties, and other factors that could cause the actual results of the Company to be materially different from the historical results or any future results expressed or implied by such forward-looking statements.

All statements within, other than statements of historical fact, are to be considered forward-looking. Although Pasinex believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not a guarantee of future performance, and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, continued availability of capital and financing, exploration results, and general economic, market or business conditions. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. We do not assume any obligation to update any forward-looking statements.