TORONTO, ON – March 30, 2023 – Pasinex Resources Limited (CSE: PSE) (FSE: PNX) (The “Company” or “Pasinex”) is pleased to provide a company update.

Andrew Gottwald, Chief Financial Officer of Pasinex, commented, “2022 was a very encouraging year for the Company. The Joint Venture experienced extremely positive results with strong margins and generated substantial positive cash flow, a large portion of which made its way to Pasinex Canada. The Company completed a number of activities in Nevada, which has ultimately led to the fulfillment of its spending obligations to earn a 51% interest in the Gunman Project. The Company is well position for another positive year in 2023. The year end audited results are expected to be released in late April.”

Cautionary Note

The Company has not completed a current technical report that includes a mineral resource estimate as defined by the Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council, and procedures for classifying the reported Mineral Resources were undertaken within the context of the Canadian Securities Administrators National Instrument 43-101 (NI 43-101). The Company has no intention of completing a NI 43-101 compliant technical report. The Joint Venture has not followed accepted quality assurance and quality control procedures with respect to its current drilling program and has not used an independent third-party laboratory for its assay analysis. The Joint Venture uses field handheld X-ray fluorescence analysers (“XRF”) for zinc assays and grade control in exploration and mining. In addition, assays are completed by an independent third-party laboratory for all of the Joint Venture’s sales.

Horzum AS and Pasinex Arama

Safety, Health and Environment

Our Joint Venture was fortunate enough that its Adana offices and the Pinargozu Mine did not sustain any significant damage during the recent tragic earthquakes in Türkiye. To ensure the safety and well-being of our employees, the operations of the Joint Venture were temporarily halted in February. Our well-trained mine rescue team, along with excavators and trucks, were mobilized to aid in the recovery efforts of nearby towns and cities. Approximately 50 personnel assisted in the clean-up and recovery efforts and were responsible for saving ten lives in Hatay, Türkiye. The Company is very proud of the contributions made by those persons and the service they provided to the local communities.

The Company is pleased to report that Horzum AS had another zero-fatality year at the Pinargozu Mine with a total of 194,504 fatality free hours having been worked at the Pinargozu Mine in 2022. Horzum AS did report four serious injuries and twelve lost time injuries during the year. Horzum AS has focused on development of a Health and Safety Management System and Culture since it began to mine at Pinargozu in 2015.

Dividends

Total amounts received by Pasinex Arama from Horzum AS in the form of dividend payments, advanced dividend payments, payments of long outstanding dividend receivables and payments of ongoing service invoices, totaled approximately $4.5 million (TRY 57 Million) using the exchange rates in effect on the dates received. Approximately $4.1 million (TRY 52.7 million) was transferred by Pasinex Arama to Pasinex Canada.

The Company is also pleased to report that Pasinex Arama received four separate payments from Horzum AS in 2023 to date, in advance of a dividend to be declared at the next annual general meeting of Horzum AS. The payments total approximately $946,000 (TRY 13,500,000) using the exchange rates in effect on the dates received. Approximately $875,000 (TRY 12,500,000) was transferred by Pasinex Arama to Pasinex Canada.

2022 Highlights

- The Joint Venture has completed 1,743 metres of exploration and development adit development during 2022;

- a total of 9,345 metres of underground and surface diamond core drilling and percussion drilling has been completed in 106 holes during 2022;

- the Joint Venture mined a total of approximately 13,800 tonnes of zinc product in 2022, which includes 12,850 tonnes of high-grade zinc sulphide product;

- the total number of pounds of zinc product produced was approximately 14.2 million pounds;

- the Joint Venture ended the year with 3,056 tonnes of high-grade zinc sulphide product in inventory;

- total sales of high-grade zinc sulphide product in 2022, were approximately 11,500 tonnes. The average grade of this material was approximately 50.1% zinc and the average sales price achieved was approximately US$1,120 per tonne; and

- the total value of all sales of zinc product during 2022 was approximately US$13.6 million.

2023 Forecast

Production at the Pinargozu Mine for 2023 is forecast to be between 11,000 and 13,000 tonnes of zinc sulphide product at an average grade in excess of 50% zinc as direct shipping material. Depending on the progress of underground exploration at Pinargozu, this production forecast could be increased in the second half of 2023. Horzum AS expects that it will complete in excess of 10,000 metres of underground and surface diamond core drilling and in excess of 900 metres of adit development in 2023. Production and diamond core drilling will be predominately underground from and in the Fourth Adit (at the 541-metre level). Horzum AS will continue to extend the existing Fourth Adit an additional 300 metres to reach the Akkaya property.

Exploration will be the key to the ongoing success of the Pinargozu and the Akkaya properties and to this effect, additional drill rigs will be in operation this year operating both underground and from surface. By the end of second quarter of 2023, three diamond drill rigs (one of which can be used in either surface or underground configuration) and one percussion rig will be operational. One of these will be used primarily to probe ahead of the development adit towards the Akkaya property to better ascertain the orientation and location of the target zone. Once that has been established, the extension of the Fourth Adit into the Akkaya property will become a major priority. The Joint Venture received its operational exploration license in November of 2022 and has three years to complete and submit various studies prior to applying for the conversion to a production licence. The Joint Venture has started this process and will engage certain consultants in 2023 to begin the process to complete the reports necessary to support the application.

Türkiye continued to experience very high inflation in 2022 and into 2023. The country was declared a hyperinflationary economy for accounting purposes in the second quarter of 2022. As a result, Horzum AS has been and will continue to experience price pressure on its goods and services incurred, including wages of its labour force. The price of zinc increased to a high of US$1.98 per pound in April of 2022 and then retreated during the remainder of the year to a price of US$1.42 per pound at year end. The average price per pound increased to US$1.58 in 2022 compared with an average price of US$1.36 per pound 2021. These price increases combined with the increase in the USD exchange rate in relation to the Turkish Lira had a positive impact on Horzum AS’s gross margins in 2022 and partially offset the increases in costs.

Gunman Project

In November 2022, Pasinex commenced a reverse circulation drilling program (“RC”), which was to include 14 drill holes totalling 3,000 metres of drilling. To date, only three drill holes have been completed with a fourth drill hole having been stopped short of its target depth. About 30% of the estimated meterage has been completed.

The drill program was originally scheduled to begin in September 2022 and be completed by October 2022, but the contracted driller was late in arriving to the property. The Company decided to proceed with the drill program, despite the late start and the more difficult drilling conditions, which began with the onset of winter, in order to complete its spending requirement to acquire the 51% interest in the Gunman Project. A combination of severe winter conditions and mechanical issues with the driller’s equipment caused numerous delays, poor performance and the low meterage drilled. The Company therefore halted the drill program in February and will recommence once weather conditions improve.

The Company did however meet its spending requirement and has exercised its option to acquire a 51% interest in the Gunman Project.

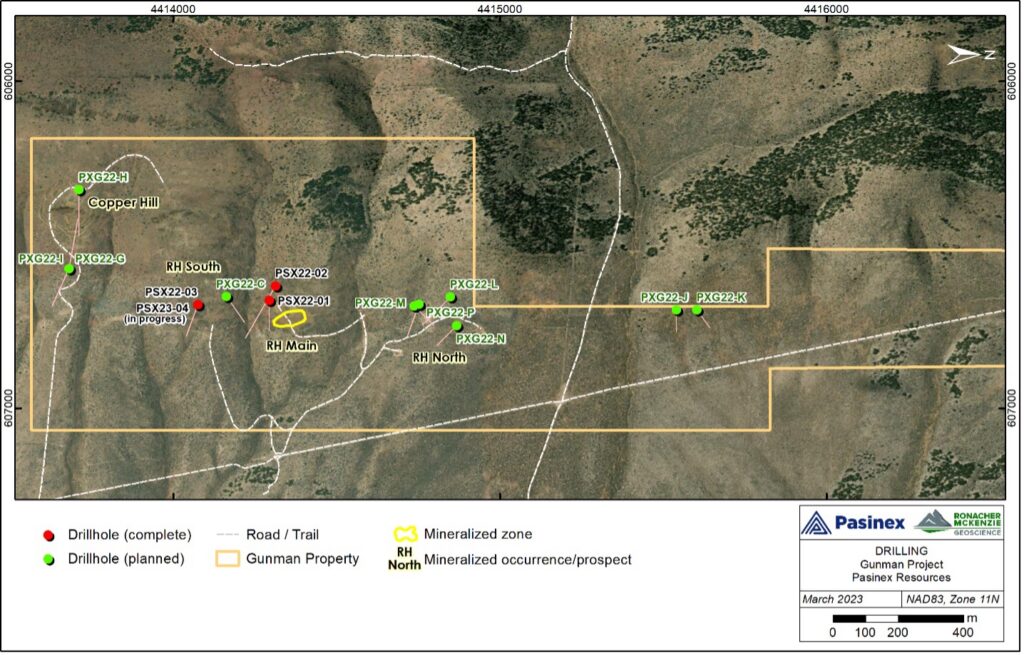

The drill program is designed to test prospects along a north-south corridor about two kilometres in length (see Figure 1). Targets include probing for potential depth extensions beneath the RH Main high-grade oxidised zinc mineralization. Targets along strike to the south at Copper Hill and RH South, and to the north at RH North, appear as centres of hydrothermal alteration with overlapping geochemical and geophysical anomalies.

None of the drill holes intersected visible zinc mineralization. As a general guide to the following drilling results, zinc concentrations between 1,000 ppm (0.1%) and 3,000ppm (0.3%) Zn would be considered significant and in general might indicate proximity to a CRD mineralizing system. Four samples from completed assays meet these criteria. Results from a portion of the fourth drill hole are still to be received.

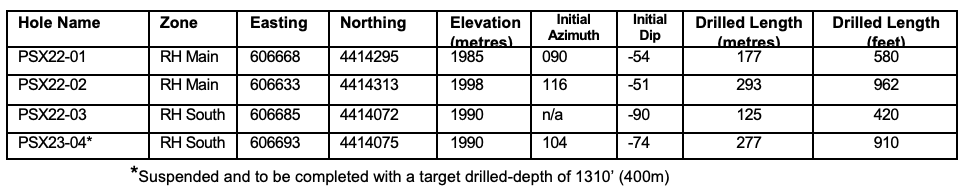

The first drill hole PSX22-01 was collared just to the south-west of RH Main and angled due east through the projected vertical extension of the RH Main mineralization. The hole remained straight when drilled. The average zinc concentration for all bedrock samples taken from a total drilled length of 580ft was about 270ppm Zn. This included elevated concentrations within the interval from 85ft to 135ft averaging 680ppm Zn, which is considered weakly anomalous. Results were disappointing in that no visible zinc mineralization was observed and that the concentrations of zinc were lower than what was expected given the proximity to RH Main.

PSX22-02 was also drilled at RH Main but stepped back about 50ft further west from PSX22-01 and angled to the southeast. Total drilled length was 962ft and the down-hole survey indicated that the hole deviated significantly from what was planned. The inclined drill hole steepened and rotated clockwise toward the north-south strike of the Ely Limestone. All bedrock samples averaged in the mid 90’s ppm Zn with just one short ten-foot interval from 435ft to 445ft averaging 900ppm Zn.

PSX22-03 was a vertical hole drilled at RH South. Total drilled length was 420ft and all bedrock samples averaged in the mid 170’s ppm Zn with a 45ft interval from 150ft averaging 635ppm Zn.

PSX23-04 was collared at RH South and angled to the southeast to target a deep low-resistivity horizon underlying a magnetic anomaly. The drill hole deviated off-target and was suspended at a drilled length of 910ft. The drill target was not reached and therefore not test as the targeted drill length was 1,310ft. Assays have been received for the first 825ft with one sample including 3,610ppm Zn in the interval from 160ft – 165ft.

Although no visible zinc mineralization has been observed to date there remain compelling targets to be tested at Copper Hill and along strike to the north including RH North.

Figure 1 – 2022-2023 planned drilling at the Gunman property. Completed drill holes are indicated with red collars and numbered suffixes. Pending drill holes are indicated with green collars and letter suffixes. RH Main zinc mineralized zone and other mineralized prospects are shown along a two-kilometre trend.

Table 1: Drill hole collar locations

(UTM Z11 NAD83)

Qualified Person

The information in this news release, relating to the Gunman Project, was compiled by geologists at Ronacher McKenzie Geoscience Inc (“RMG”), Sudbury, Ontario. The drilling and collection of samples was supervised on site by Ms. Elizabeth Zbinden PhD, Senior Geologist with RMG. The information in this news release, relating to the Gunman Project, was reviewed and verified by John P. Barry, EurGeol, P.Geo, FSEG managing director of Irus Consulting Ltd and a qualified person as defined by National Instrument 43-101 with 35 years international experience including at least five years relevant experience on various types of zinc-rich deposits such as Irish-type/MVT, Sedex, CRDs and VHMS deposit types. Mr. Barry is an independent consultant. Mr. Barry has previously been on site and he is familiar with the geology, mineralization and terrain at Gunman.

Quality Assurance/ Quality Control

Pasinex complies with a robust Quality Assurance and Quality Control (“QA/QC”) program in relation to drill-chip and drill-core handling, security, photography, sampling, documentation and transportation of samples. RC samples are taken every five feet. Contractors are instructed to follow standard operating and quality assurance procedures designed to ensure that all sampling techniques and sample results meet international reporting standards. RC is done wet, for dust abatement reasons. The sample stream passes through a cyclone splitter, where a representative fraction is collected, and the balance is discharged into a sump. Bagged 5-foot samples are collected from site and delivered to the ALS preparation lab in Elko, Nevada by RMG personnel. Samples are then oven-dried and undergo a fine crush with 70% passing 2mm. The sample is then riffle split and a split up to 250g is pulverized to 85% passing 75 microns and sent to ALS analytical lab in Vancouver, Canada. In Vancouver, the sample is analyzed using their ME-ICP61a method. A 0.25gm split is digested using a near-total four-acid process and then analyzed for 33 elements including zinc by inductively coupled plasma atomic emission spectroscopy (ICP-AES). Samples over 10,000ppm Zn are re-analyzed using the same digestion and analytical method but with a recalibrated upper limit of 30% Zn. To ensure analytical precision, representativeness of sample and detection of any contamination, QA/QC samples are inserted into the sample-train by RMG as follows: every tenth drill-sample is followed by either a blank or standard (equal numbers of blanks and standards). The certified standard is commercially prepared (OREAS 135b, 2.73% Zn). The standard is also certified for 28 other elements. The blanks are coarse dolomitic marble chips. Every twenty-fifth drill-sample is collected at the drill-site in duplicate for analyses.

Qualified Person

Jonathan Challis, a Fellow of the Institute of Materials, Minerals and Mining and a Chartered Engineer, is the qualified person (“QP”) as defined by NI 43-101 for all information in this news release other than the information relating to the Gunman Project. He has inspected the original paid sales invoices issued by the Joint Venture for the shipment of zinc sulphide product specified in this news release and has approved the scientific and technical disclosure herein. Mr. Challis is a director of the Company and Chair of the Joint Venture.

About Pasinex

Pasinex Resources Limited is a Toronto-based mining company that owns 50% of Horzum Maden Arama ve Isletme Anonim Sirketi (“Horzum AS” or “Joint Venture”), through its 100% owned subsidiary Pasinex Arama ve Madencilik Anonim Sirketi (“Pasinex Arama”). Horzum AS holds 100% of the producing Pinargozu high-grade zinc mine. Horzum AS sells directly to zinc smelters and or refiners through commodity brokers from its mine site in Türkiye. The Company also holds a 51% interest, with an option to increase to an 80% interest of a high-grade zinc exploration project, the Gunman Project, located in Nevada. Pasinex has a strong technical management team with many years of mineral exploration and mining project development experience. Pasinex Resources Limited mission is to explore and extract high grade ore to drive growth and wealth for all of its stakeholders including shareholders, employees and the communities of our operations, meeting all requirements in safety, health and the environment.

Visit our website at www.pasinex.com.

On Behalf of the Board of Directors

PASINEX RESOURCES LIMITED

“Andrew Gottwald”

Andrew Gottwald

Chief Financial Officer

Phone: +1 416.861.9659

Email: [email protected]

Evan White

Manager of Corporate Communications

Phone: +1 416.906.3498

Email: [email protected]

The CSE does not accept responsibility for the adequacy or accuracy of this news release. This news release includes forward-looking statements that are subject to risks and uncertainties. Forward-looking statements involve known and unknown risks, uncertainties, and other factors that could cause the actual results of the Company to be materially different from the historical results or any future results expressed or implied by such forward-looking statements. All statements within, other than statements of historical fact, are to be considered forward-looking. Although Pasinex believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not a guarantee of future performance, and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, continued availability of capital and financing, exploration results, and general economic, market or business conditions. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. We do not assume any obligation to update any forward-looking statements.